As the battle over student loan forgiveness rages on in Congress and the White House, borrowers anxiously await some semblance of clarity from the Capitol.

Progressives, moderate Democrats, and the current administration have lobbed financial figures and proposed plans over Capitol Hill like so many artillery shells, leaving student loan borrowers questioning whether it’s all just for show or if a resolution is in sight.

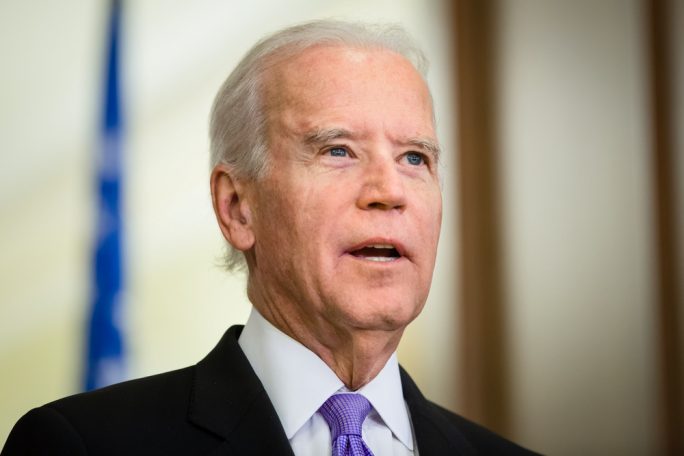

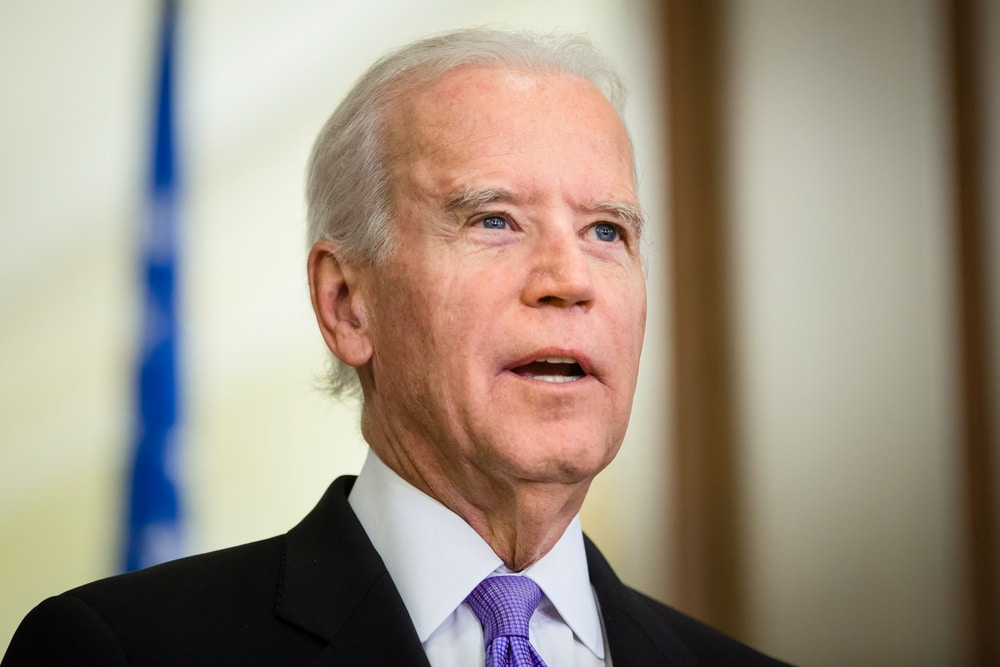

In this article, we’ll take a deep dive into Joe Biden’s student loan forgiveness plan and its alternatives, dissecting what the major players have said, projecting the most likely outcome, and analyzing the future implications of federal student loan relief.

What We Know About Joe Biden’s Relief Plan for Student Loans

While running for President as the Democrat nominee, Joe Biden made student loan debt forgiveness part of his platform. After winning the election and before his inauguration, Biden and his staff reiterated their dedication to cancel $10,000 in federal student loans per borrower. As of now, that hasn’t changed.

Joe Biden, Post-Inauguration

Joe Biden has expressed a willingness to forgive $10,000 per student loan borrower via executive order but refused to consider canceling any amount above that mark. Simply put, the President believes he lacks the authority to grant the higher amount of relief that Progressive Democrats and liberal Democrats want.

Should Biden put pen to paper and grant student loan forgiveness in the amount of $10,000 per borrower, it would wipe the slate clean for the 15 million Americans who bear a student debt burden of $10,000 or less. The 30 million student loan debtors who have more than $10,000 in federal loans would receive only partial relief, a result that Progressive Democrats find insufficient.

Outside Pressure Applied on Joe Biden

In February of 2021, 17 state attorneys-general pleaded for the President to forgive $50,000 per federal student loan borrower, claiming that Biden remained free to sign such an executive order under federal law. However, the President continues to explore the possibility, relying on the ongoing advice from his cabinet and other federal appointees.

Last month, over 400 charities, lobbyist groups, think tanks, and other organizations asked Biden to cancel all federal student loans. They claimed it would boost the American economy, reduce racial inequality, and help ordinary Americans recover from the economic hardships that the COVID-19 pandemic caused. However, onlookers see no sign of movement from the President.

America Waits While Democrats Strategize

Millions of former students who carry federal education loans wonder why the new President has yet to follow through on his campaign promises regarding student debt.

Most likely, he prefers to wait for Congress to act so that the Executive Branch and Legislative Branch can share both the praise and criticism that will follow. Acting unilaterally through executive order would mean that Biden would become the sole recipient of the political blowback.

Another possible reason that the President hasn’t granted the promised relief involves the inevitable court challenges, which would delay relief. Also, a loss in the courts would cause considerable damage to his credibility.

Suppose Biden does continue to sit back in the hopes of a student debt relief bill passing both chambers of Congress. In that case, one could chalk it up to the universal understanding in Washington, D.C., that such legislation would enjoy a much higher chance of surviving a Supreme Court challenge than an executive order would.

For now, student loan borrowers will have to wait to see who acts first: President Biden or Congress. Biden’s student loan forgiveness plan remains on hold in the meantime. Student debtors find themselves forced to continue combing the news in search of new developments until something meaningful occurs.

Student Loan Forgiveness in Congress

Congress currently has no student loan forgiveness bill in front of it. In February, members from both chambers of Congress introduced resolutions asking for $50,000 in student loan forgiveness per borrower, echoing previous demands that Progressive Democrats had made.

Senators Chuck Schumer and Elizabeth Warren have spearheaded the Congressional push for the forgiveness of federal student loans. Both have asked Biden to cancel $50,000 in federal student debt per borrower but to no avail.

In March, Biden signed the American Rescue Plan Act, which, in part, made any future discharge of federal student loan indebtedness tax-free through the year 2025. Sen. Warren hailed it as the forerunner to substantive student debt forgiveness because it bars the IRS from deeming such discharges as taxable income. However, more than two months later, nothing further has happened.

Last month, Warren reiterated the need for Biden to cancel $50,000 in student debt per borrower, although her appeal appears to have fallen on deaf ears.

The situation seems to be an intentionally created Catch-22 in which Congress has called for the President to act, and he has called upon Congress. Both parties wish to take the credit for any future student debt relief, but neither wants to take the blame. As such, Congress and the Presidency have reached a political impasse, with the American public seemingly stuck in a holding pattern, at least for now.

Ongoing Student Loan Forbearance

With the advent of the COVID-19 pandemic, the Trump administration instituted a federal student loan forbearance program, which later received an extension at the end of 2020. Set to expire in January of 2021, the program secured a further extension from the Biden administration immediately after the Presidential Inauguration and will expire at the end of September.

The federal student loan forbearance program accomplishes the following:

- Halts all federal student loan payments

- Pauses the accrual of interest on the principal

- Forbids all collection activity on defaulted loans

Alternative Forms of Student Debt Relief That Biden Has Suggested

While campaigning for President in 2020, Biden expressed his support for several Progressive measures regarding student debt relief. While some of his statements undoubtedly served to garner voters’ support despite their impracticality, they likely reflect Biden’s actual positions on the student debt crisis.

Bankruptcy Filers

Biden has stated several times that he would like to loosen restrictions regarding the discharge of private student loans through bankruptcy. Under current bankruptcy law, petitioners must take the extra step of filing a special adversary proceeding to prove undue hardship. Essentially, it represents a lawsuit within a lawsuit.

Low-income Borrowers

Biden and other Democrats have suggested canceling the student debt of low-income borrowers. The threshold number heard around Washington, D.C., stands at $125,000 in annual income. Since this is a relatively high threshold that would include millions of borrowers who could ostensibly afford to pay off their student debt, this number could come down.

The other threshold that lawmakers might consider involves the amount of student debt that individual borrowers owe. It seems unlikely that a borrower who makes $124,999 a year and owes $5,000 of student loan debt would ever qualify for cancellation. However, other considerations may factor in, as well.

Historically Black Colleges and Universities (HBCUs)

Also in relation to the $125,000 threshold, HBCUs and Minority Serving Institutions (MSIs) may ultimately play a role in Biden’s student loan cancellation plan. Students who attended public universities, private HBCUs, or MSIs may receive special consideration once the progressive student debt forgiveness program becomes law.

Public Servants

Biden has expressed his desire to enhance the current Public Service Loan Forgiveness (PSLF) program, which allows for the cancellation of federal student loan debt for borrowers who work for qualifying public or non-profit employers, have remitted 120 monthly payments on their loans, and meet other criteria. Unfortunately, the program has rejected 98% of applicants.

To remedy the abysmal acceptance rate of the PSLF, Biden has said that he would like to amend it so that 50% of a public servant’s federal student loan debt would receive forgiveness after five years of work for qualified employers.

President Biden has expressly stated that he would also like to create a new program by offering $50,000 in federal student loan forgiveness to those who complete five years of work in public service. Every year, for five years maximum, borrowers would see their total student loan debt balance automatically reduce by $10,000.

While this plan may not eliminate all student loan debt for certain individuals, it most certainly would cancel more overall debt than the PSLF program due to an almost universal acceptance rate.

Amended Income-Driven Repayment Plan

Other options may become available for borrowers who would not qualify under Biden’s student loan forgiveness plans. One such option includes an amended income-driven repayment plan for student loans.

Under the proposed amendment, borrowers with federal student loans for undergraduate education would only pay 5% of their discretionary income every month, down from the 10% to 20% that borrowers pay under the current plan. Individuals making less than $25,000 per year would not have to make monthly payments at all.

After twenty years, the federal government would forgive the remaining balance, free of tax. Borrowers can opt out of the plan but would otherwise find themselves automatically enrolled in the program.

Free College Tuition

Under the Biden administration’s proposed American Families Plan, aspiring students could receive two years of college tuition that American tax dollars would fund. Students pursuing a degree or certificate at a community college, HBCU, or MSI would receive enough funds to cover tuition costs for two years, which the U.S. government would pay directly to their chosen school.

The American Families Plan would not cover the associated costs of secondary education, such as books, housing, and meal plans.

Unsatisfied with the American Families Plan, certain Progressive members of Congress have called for additional support for students. Senator Bernie Sanders and Representative Pramila Jayapal put forth the College for All Act, which would provide a free community college education for anyone who wants it.

The bill would also provide a free, 4-year tuition for students whose families make less than $125,000 per year if the student should choose to attend a public college or university, HBCU, or MSI.

Conclusion

While nothing concrete has developed, the President and members of Congress find themselves under tremendous pressure to produce something of substance to help relieve the student loan burden. Student borrowers, lobbyist organizations, and other interested parties wait with bated breath while the political wrangling plays out.

A new law in place by the year’s end would represent a significant achievement. Still, those who continue to follow the Biden administration’s student loan forgiveness plan story may have to wait until 2022.